Early Exit

if for any reason you wish to get out of the agreement before the end of year 3, you have two exit points available to you ...

Exit 1 - at end of year 1 you can end the agreement with profit @ 5% per year

your Profit is show in ( column D )

Exit 2 - at end of year 2 you can end the agreement with profit @ 5% per year ( Total Profit 10% )

your Profit is shown in ( column E )

Notice Required: please send me a 12 months written notice when you wish to end your agreement in Year 1 or Year 2

Exit 1 - to end your agreement at the end of year 1, you must issue your written notice within 30 days of signing the Agreement

Let's work through a few examples ...

How much of your Property Tax and Debt Payments do you want to SAVE each year ?

to pay for your ...

Example A: Reduce $10,000 Property Tax to $0

find $10,000 in ( column A ) of the Payment Table above

to reduce your Property Tax to $0

you need to Deposit $30,000 ( column B ) into Income Builder

this Deposit will be Returned to you at the end of our agreement

At end of year 3 your Deposit will increase by 100% to give you a Profit of $30,000 ( column C )

Total Profit at end of year 3 is $30,000

$10,000 Property Tax SAVED each year

YOU HAVE REDUCED your Property Tax to $0

( our 3 years agreement has paid for 3 Years of Property Tax @ $10,000 per year )

TOTAL PAID = $60,000 ( your Deposit $30,000 plus Profit $30,000 )

Early Exit

if for any reason you wish to get out of the agreement before the end of year 3, you have two exit points available to you ...

Exit 1 - at end of year 1 you can end the agreement with profit @ 5% per year

your Profit will be $1,500 ( column D )

Exit 2 - at end of year 2 you can end the agreement with profit @ 5% per year ( Total 10% )

your Profit will be $3,000 ( column E )

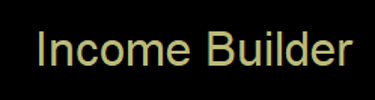

To Reduce your Property Tax or any Yearly Payment to $0

select the Yearly Payment from ( column A ) in the Payment Table below ...

You will need to Deposit the amount in ( column B ) into Income Builder

this Deposit will be returned to you at the end of our 3 years Agreement

Year 3 Target - to reach the Year 3 Target in( column C ) there will be $0 withdrawals until end of year 3

at end of year 3 you will earn 100% Profit and your Deposit ( column B ) will be returned

Your Total Profit will be as shown in ( column C )

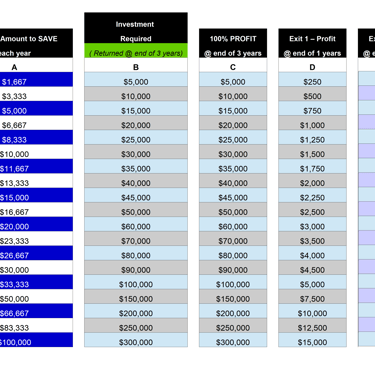

Example B: Reduce ALL your Yearly Payments to $0

Let's say you have the following Yearly Payments ....

Property Tax - $5,000 per year

Mortgage Payments - $14,000 per year

Car Payments - $8,700 per year

Health Insurance - $10,200 per year

Loan Payments - $12,100 per year

TOTAL YEARLY PAYMENTS = $50,000

find $50,000 in ( column A ) of the Payment Table above

to reduce your Debt Payments to $0

you need to Deposit $150,000 ( column B ) into Income Builder

this Deposit will be Returned to you at the end of our agreement

At end of year 3 your Deposit will increase by 100% to give you a Profit of $150,000 ( column C )

Total Profit at end of year 3 is $150,000

$50,000 Debt Payments SAVED each year

YOU HAVE REDUCED your Yearly Debts Payments to $0

( our 3 years agreement has paid for 3 Years of Debt Payments @ $50,000 per year )

TOTAL PAID = $300,000 ( your Deposit $150,000 plus Profit $150,000 )

EARLY EXIT @ 5% Profit: all our agreements can be terminated at the end of year 1 and year 2 with a Profit of 5% per year

REDUCE Property Tax and Debts to $0

Payment Table

Early Exit

if for any reason you wish to get out of the agreement before the end of year 3, you have two exit points available to you ...

Exit 1 - at end of year 1 you can end the agreement with profit @ 5% per year

your Profit will be $7,500 ( column D )

Exit 2 - at end of year 2 you can end the agreement with profit @ 5% per year ( Total 10% )

your Profit will be $15,000 ( column E )